Fintech Startup Unicorns: Your Future Is Possible With Crunch.

28th February 2024

Have you got an innovative idea, ready and waiting for development and investment? Perhaps you have a future fintech ‘unicorn’ on your hands, but aren’t sure where to start?

Crunch is your gateway to a fully-fledged development team; allowing you to focus on your products identity and marketing.

What is stopping me from developing my fintech product myself?

In the world of card issuance, there are many hurdles to face before getting your first product into production.

With an increasingly competitive market projected in the next few years, card programme creators must remain diligent in their research. Cutting corners could result in potential legal action, as a result of negligence or abetting criminal activity.

Creating your card programme independently, you would seek out, vet, negotiate and liaise with each of the following providers:

- Find a Card Issuer

- Find a Card Processor

- Select a Card Scheme

- Set up a BIN

- Find a Payments Clearing Partner

- Choose a Card Manufacturer

- Find a 3D Secure Provider

- Integrate Tokenisation Providers

- Design your cards and packaging

The good news? When you start your card programme with Crunch, our trusted partners handle these decisions on your behalf! That’s the power and ease of our full-stack solutions!

Partnering with Mastercard, we provide a fully-integrated solution to suit your needs. With our assistance, your card programme could be up and running in a couple of months. By handling the complexities of starting your card programme, you can focus on running your business and planning your strategy.

Why should I use Crunch to fully develop my fintech startup programme?

Our partners, colleagues and associates have decades of experience within the fintech sector. We have seen trends come and go, but our core values remain the same:

Innovation. Safety. Compliance. Excellence.

With our trusted partners at Mastercard, our technology created the foundations of Revolut and Starling. Our technology is changing the game within the fintech sector and beyond.

Trusted financial safeguarding.

Our product protects businesses that represent the most vulnerable people in our society. Crunch allows vulenrable users to navigate online banking safely and easily. Examples of this include Osper, a children’s pocket money card, and Cleva, a financial system for vulnerable adults and carers.

Our technology is enabling businesses such as these to instil safety for their customers, with the financial service they provide. This only highlights Crunch’s track record further, underlining the financial safeguarding that Crunch could create from the ground up.

Constant and proactive innovation

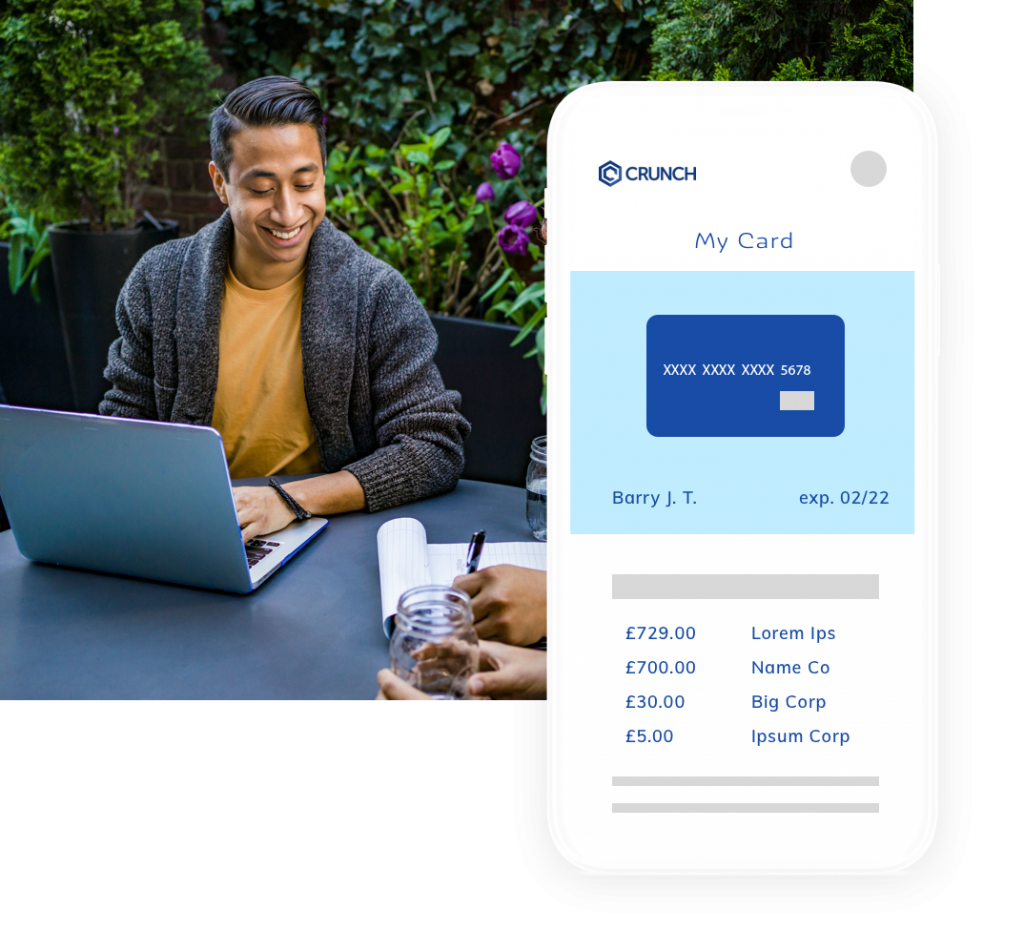

Crunch’s development teams consistently hit the ground running, striving to develop the next generation of Crunch UX/UI features. To find out about our development releases in January alone, check out our previous blog for our real world examples.

Reliable and customisable framework

Stand aside odd-job developers: our full-stack solution holds a foolproof and steadfast framework for cardholders and managers alike. From cardholder apps, to management portals; every aspect of monitoring, limiting and spending is covered with Crunch’s one-stop-shop programmes.

To find out about our white-label and ready-for-market packages, take a look at our solutions page!

‘Crunch’ the numbers with us.

Want to find out about our packages, and whether Crunch could help get your fintech startup off the ground? Get in touch with our passionate team, and let’s begin discussing your future with us today.